Paytm Q1 FY26 Finally in Profit Zone!

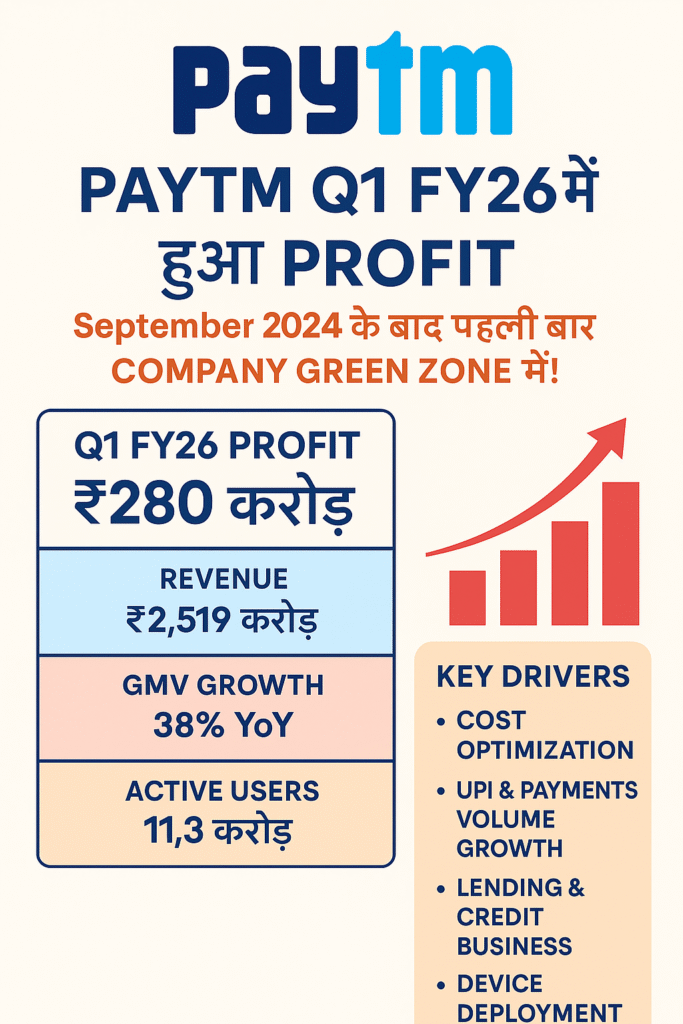

Digital payments company Paytm (One97 Communications Ltd) ne finally apna pehla quarterly Paytm Q1 FY26 profit me dikhaya hai. September 2024 ke baad pehli baar, company ne ₹280 crore ka consolidated profit report kiya hai.

Ye news retail investors aur fintech sector ke liye ek major turnaround signal ke roop me dekhi ja rahi hai. Is blog me hum dekhenge:

- Paytm Q1 FY26 profit ka complete profit analysis

- Kya ye turnaround sustainable hai?

- Expert opinion

- Stock ka future kya ho sakta hai?

- Kya investors ke liye entry opportunity hai?

Paytm Q1 FY26 Profit – Highlights

| Financial Metric | Q1 FY25 | Q1 FY26 |

|---|---|---|

| Revenue | ₹2,341 Cr | ₹2,519 Cr |

| Net Profit | -₹300 Cr | ₹280 Cr |

| EBITDA | ₹84 Cr | ₹288 Cr |

| GMV Growth | 30% YoY | 38% YoY |

| Active Users | 9.8 Cr | 11.3 Cr |

Paytm ke numbers batate hain ki company ne cost-cutting ke sath-sath revenue generation pe bhi focus kiya hai.

Profit Aaya Kaise? – Key Drivers

- Cost Optimization:

Operating expenses reduce hue hain, jiska direct impact margins pe pada. - UPI & Payments Volume Growth:

Company ne apna merchant network expand kiya hai, jiska direct असर GMV (Gross Merchandise Value) ke strong growth par दिखा. ये performance dikhata hai ki Paytm apne business operations ko streamline karne mein सफल रही hai aur market demand ke साथ smart तरीके se adjust kar rahi hai. - Lending & Credit Business:

Paytm ne BNPL (Buy Now Pay Later) aur personal loan segment me accha traction liya hai. - Device Deployment:

Soundbox aur QR devices ka aggressive expansion hua hai rural aur tier-2 cities me.

September 2024 ke baad Pehla Profit – Kya Ye Turnaround Hai?

Paytm ne 2021 ke IPO ke baad se consistent losses report kiye the, jiska major reason tha:

- Aggressive expansion

- High marketing spends

- Regulatory restrictions on lending

Lekin ab 2025-26 me Paytm ne:

- Profitability pe focus kiya

- Operational discipline laaya

- Core payment business ko streamline kiya

Ye sab signal karte hain ki company ab mature ho rahi hai aur startup phase se exit le rahi hai.

Paytm Q1 FY26 Profit

Expert Opinion – Kya Analysts Keh Rahe Hain?

ICICI Securities:

“Paytm ka profit post karna ek structural turnaround signal deta hai. Agar company ye momentum banaye rakhti hai, to stock upside de sakta hai.”

JM Financial:

“Short-term me stock me volatility ho sakti hai, lekin long-term me valuation justify hone lag gaye hain.”

Paytm Q1 FY26 Profit

Paytm Share Price – Kya Karein Investors?

| Situation | Recommendation |

|---|---|

| Already Holding | Hold – Trend positive hai |

| Fresh Entry | Wait for next quarter results confirmation |

| Short-Term Trader | Book partial profit above ₹550–₹600 levels |

| Long-Term Investor | SIP approach se entry consider kar sakte hain |

Paytm Stock Forecast 2025 – Analyst Estimate

| Month | Estimated Price Range |

|---|---|

| August 2025 | ₹580 – ₹620 |

| October 2025 | ₹650 – ₹700 (if profitability sustains) |

| December 2025 | ₹700+ (on continued growth) |

Note: Ye projections market sentiment, results, aur regulations ke basis par change ho sakti hain.

Read More –

- The Hindu – Paytm Q1 FY26 Profit News

- Paytm Financials – Moneycontrol

- IRFC Stock Tumbles 35% After 551% Surge

- Income Tax Bill 2025

- Reliance Share Price Q1 FY25

FAQs – Paytm Q1 FY26 Profit से जुड़े सामान्य सवाल

1.Paytm Q1 FY26 profit mein Paytm ne profit kitna kamaya?

Paytm ne Q1 FY26 mein ₹234 crore ka profit report kiya, jo September 2024 ke baad pehla quarterly profit hai.

2. Kya ye Paytm ka pehla profit hai?

Nahi, lekin ye September 2024 ke baad ka pehla sustainable profit hai.

3. Paytm ke profit ka main reason kya tha?

Merchant base expansion aur GMV (Gross Merchandise Value) mein strong growth.

4. GMV ka kya matlab hai?

GMV ka matlab hai total transaction value jo platform par hoti hai.

5. Kya Paytm ab stable business model par kaam kar rahi hai?

Haan, Paytm ne cost control aur revenue generation dono areas mein progress dikhayi hai.

6. Paytm ke kis segment ne sabse achha perform kiya?

Merchant payments aur loan distribution segment ne strong growth dikhayi.

7. Kya ye profit one-time hai ya consistent ho sakta hai?

Company ka kehna hai ki ye profit trend sustainable hai.

8. Investors ka reaction kaisa raha?

Stock mein halki tezi dekhi gayi, lekin investors abhi cautious optimism dikha rahe hain.

9. Kya RBI ke rules ka asar ab bhi hai?

RBI restrictions ka impact kam hua hai, lekin long-term compliance zaroori rahega.

10. Kya Paytm ka IPO ke baad ka downfall khatam ho gaya hai?

Yeh kehna jaldi hoga, lekin profit ek positive signal hai.

11. Loan book kis speed se grow ho rahi hai?

Loan distribution mein quarterly double-digit growth dekhi gayi hai.

12. Kya Paytm fir se long-term ke liye invest karne layak hai?

Agar company sustainable profit maintain karti hai to long-term ke liye promising ho sakti hai.

13. Kya Paytm UPI market mein bhi grow kar rahi hai?

Haan, UPI transactions mein bhi steady growth dikh rahi hai.

14. Paytm ke competitors kaun hain?

Google Pay, PhonePe, Amazon Pay jaise players abhi bhi strong competitors hain.

15. Kya Paytm future mein dividend de sakti hai?

Agar consistent profit hota raha to dividend देने की संभावना बढ़ जाएगी.

Paytm Q1 FY26 Profit