IRFC stock ki chamatkari rally kya ab ruk gayi hai?

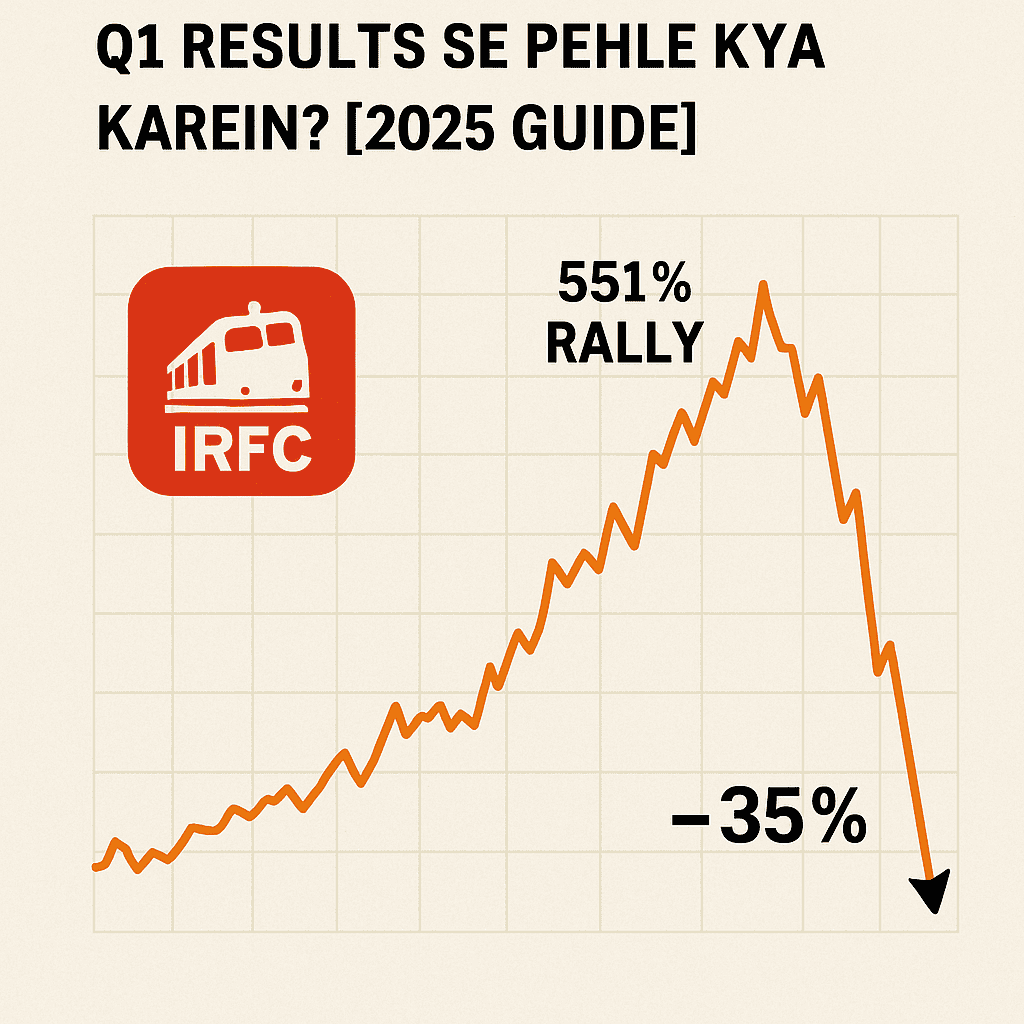

Indian Railway Finance Corporation (IRFC) stock ka last 3 saalon me investors ka favorite bana raha, jisme approx 551% ka surge dekhne ko mila. Lekin ab July 2025 ke mahine me IRFC stock 35% tak gir chuka hai apne all-time high se. Is girawat ne retail investors ke beech confusion create kar diya hai — Q1 results se pehle kya strategy rakhein?

Is blog me hum dekhenge:

- IRFC Stock ke fundamentals

- Q1 FY25 results ki expectations

- Analyst views

- Buy, Sell ya Hold decision kaise lein

- Aur long-term investors ke liye kya signal hai

IRFC Stock: 3-Year Rally Ka Breakdown

2022 se 2025 ke beech IRFC ke shares ne consistently market ko beat kiya aur investors ko zabardast return diya.” PSU reforms, strong financials, aur railways ke modernization plans ke chalte investors ne isme trust dikhaya.

| Year | Price Surge |

|---|---|

| 2022 | +120% |

| 2023 | +185% |

| 2024 | +140% |

| 2025 (YTD till June) | +106% |

July 2025 tak aate-aate, IRFC ke shares apne all-time high se lagbhag 35% neeche aa chuke hain

IRFC Stock 35% Girne Ki Wajah Kya Hai?

- Profit Booking:

500%+ return ke baad institutional investors ne heavy profit booking start kar diya hai. - Valuation Concerns:

Stock ka P/E ratio ab PSU average se upar chala gaya tha. Correction ek natural reaction hai. - Q1 Results Ke Expectations:

Investors ko Q1 FY25 ke results se kaafi umeedein hain, aur woh strong numbers ki expectation me hain.”. Any minor miss can trigger volatility. - Overall Market Sentiment:

PSU stocks me overall correction aaya hai, aur IRFC bhi us impact me aa gaya.

Q1 FY25 Results: Kya Expect Kar Sakte Hain?

IRFC ne FY24 me record profit post kiya tha — ₹6,400 crore ke aaspaas. Ab Q1 FY25 me:

- Revenue Growth: Estimated 12-15% YoY

- Net Profit: ₹1,700–1,850 crore expected

- Loan Book Expansion: Railways ke capital projects se loan demand barhne ki ummeed

Agar yeh numbers expectations ke kareeb rahe, to stock me rebound possible hai.

Expert & Analyst Opinions

Motilal Oswal:

“IRFC fundamentals strong hain. Correction long-term investors ke liye entry opportunity ho sakta hai.”

ICICI Direct:

“Q1 results ke baad hi fresh entry lena better hoga. 30–32 range ek strong support zone hai.”

IRFC Share Price Prediction 2025

| Month | Estimated Price Range |

|---|---|

| July 2025 (Current) | ₹34–36 |

| Post Q1 Results | ₹38–42 (on strong results) |

| December 2025 | ₹48–52 (long-term bullish) |

Note: Yeh sirf estimated range hai, market volatility aur economic events ke hisaab se change ho sakti hai.

IRFC Stock: Buy, Sell Ya Hold?

✅ Buy – Agar aapka time horizon 2–3 saal ka hai aur aap PSU stocks me trust karte hain

✅ Hold – Agar aapne ₹30–35 ke beech buy kiya hai to Q1 results ka wait karein

❌ Sell – Agar aap short-term trader hain aur profit already book kar chuke hain

Long-Term Potential of IRFC

- Monopoly Business Model – Indian Railways ka primary financing arm

- Low Risk of Default – Government-backed operations

- Stable Dividend Payouts – Regular dividend yield of 3–4%

- IRFC apni loan book ko aggressively expand kar raha hai, jiska target FY28 tak ₹5 lakh crore tak pahuchne ka hai.”

IRFC ka role next 5 saal me aur bhi bada hone wala hai, specially infrastructure financing aur bullet train projects ke chalte.

Read More –

- IRFC Q4 Results 2024 – Economic Times

- IRFC Financials – Moneycontrol

- Income Tax Bill 2025

- Eternal Shares 2025

FAQs – IRFC Stock 2025

Q1. Kya IRFC abhi buy karna safe hai?

Agar aap long-term investor hain aur volatility manage kar sakte hain, to haan — current correction ek entry opportunity ho sakta hai.

Q2. Q1 results kab expected hai?

IRFC ke Q1 FY25 results July ke end ya August 1st week tak announce ho sakte hain.

Q3. IRFC ka dividend yield kitna hai?

Approx 3–4% ka dividend yield milta hai annually.

Q4. Kya IRFC penny stock hai?

Nahi, IRFC ek mid-cap PSU stock hai jo consistent dividend aur profit generate karta hai.