2025 mein Indian stock market IPOs ka ek naya wave dekh raha hai. Lekin ek question sabse pehle aata hai – IPO kya hota hai? Is part mein hum IPO ka full meaning, process aur investor ke liye iska kya matlab hota hai, sab kuch detail mein samjhenge.

Table of Contents

IPO Ka Matlab Kya Hota Hai?

IPO ka full form hota hai Initial Public Offering. Jab koi private company pehli baar apne shares public ko offer karti hai stock exchange ke through, us process ko IPO kaha jata hai. Yeh ek major step hota hai kisi bhi company ke liye jab wo apne business ko expand karne ke liye public se capital raise karti hai.

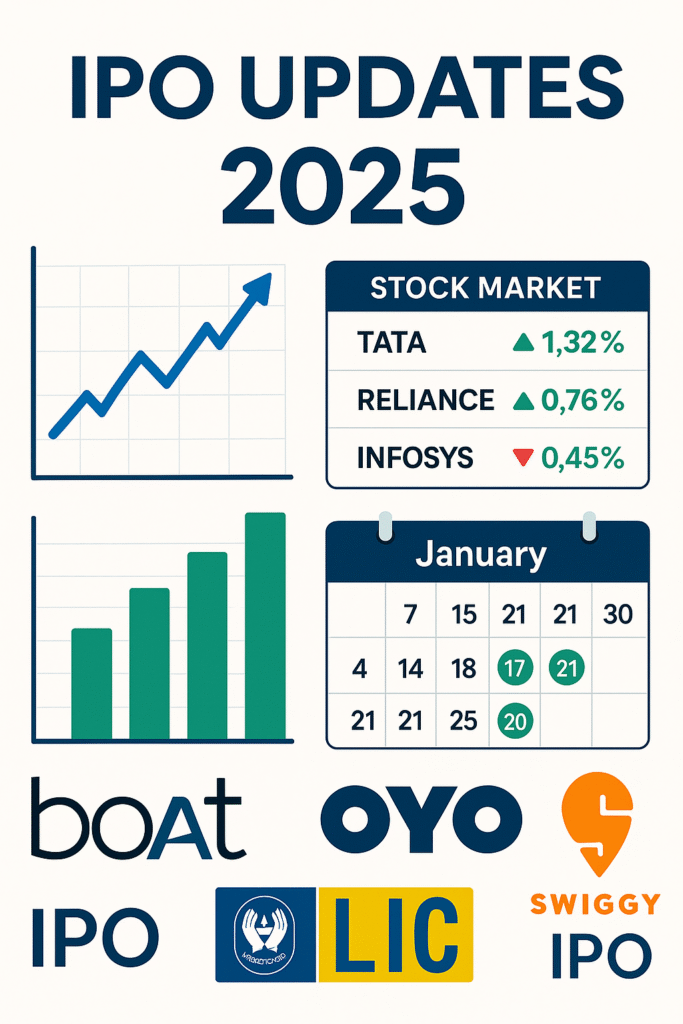

IPO Updates

IPO Issuance – Kaise Hoti Hai Tayari?

IPO lane se pehle company ko SEBI (Securities and Exchange Board of India) ke rules ko follow karna padta hai. IPO process kuch important stages se guzarti hai:

- Draft Red Herring Prospectus (DRHP) – Yeh ek detailed document hota hai jo company ki financials, risk factors, aur fund utilization ka breakdown deta hai.

- SEBI Approval – SEBI DRHP ko review karta hai aur agar sab kuch sahi hota hai toh approval milta hai.

- Roadshows & Investor Meet – Company apna IPO promote karti hai investors ke beech.

- Price Band & Bidding – IPO ka price band set hota hai aur investors us range me bid karte hain.

- Allotment & Listing – Shares investors ko allot kiye jaate hain, aur stock exchange pe listing hoti hai.

IPO Updates

IPO Lane Ka Purpose Kya Hota Hai?

- Capital raise karna business expansion ke liye

- Company ka brand value aur visibility badhana

- Existing investors ko exit option dena

- Debt repay karna

Retail Investor ke Liye IPO Kyun Important Hai?

- Listing Gains: IPO price se zyada price pe listing hone par profit hota hai.

- Long-Term Investment: Strong fundamentals wali company me investment ka mauka.

- First Entry: Company ke shares sabse pehle lene ka moka sirf IPO me hota hai.

IPO Updates

IPO Updates Investment ke Risks:

- Listing day par price gir bhi sakta hai

- Short-term volatility high hoti hai

- Fundamentals samajhna important hai

2025 IPO Updates ke Context Me IPO Samajhna Kyun Zaroori Hai?

2025 mein naye startups, fintechs, AI companies aur PSU firms IPO lane wale hain. IPO investment se pehle samajhna zaroori hai ki company kya karti hai, kyun IPO laa rahi hai aur kya usme aapka paisa safe hai. Isiliye humne yeh IPO Updates (Part 1) start kiya hai jisme aapko poora knowledge diya jaa raha hai step-by-step.

Kya Hota Hai Share Bazaar Mein Nayi Company Ka Entry? (2025 Edition)

2025 mein kaafi saari naye companies ne apni financial journey share market ke zariye shuru ki hai. Lekin sawal yeh hai ki jab koi company publicly list hone jaati hai, toh process kya hota hai, aur aapko kaise pata chale ki kaunsi investment opportunity valuable ho sakti hai?

IPO Updates

1. Naye Listing ka Matlab Kya Hai?

Jab koi private company apne shares public ko offer karti hai, toh usse hum kehte hain ki company “public ho rahi hai.” Yeh ek important financial event hota hai jahan pe investors pehli baar us business ka ek chhota hissa kharid sakte hain.

2. 2025 Mein Ab Tak Kya Trend Dekhne Ko Mila?

Is saal naye listings mein ek zabardast surge dekhne ko mila hai. Healthcare, fintech, renewable energy, aur AI sectors se related companies ne zabardast interest create kiya hai. Zyada tar applications oversubscribed hui hain, iska matlab hai logon ka bharosa aur demand dono high hai.

3. Investors Ke Liye Kya Mauke Hain?

Agar aap long-term investor hain, toh naye listings ek accha entry point de sakte hain — especially agar company ka business model strong ho, aur growth story promising ho. Lekin short-term traders ke liye bhi yeh ek opportunity hoti hai listing day par quick profit book karne ki.

4. Risk Kya Hai?

Har naye share listing ke saath kuch risk bhi jude hote hain:

- Listing ke baad share price volatile ho sakta hai

- Company ki financials hamesha transparent nahi hoti

- Grey market premium misleading ho sakta hai

IPO Updates

5. 2025 Ke Initial Listing Ke Highlights

Iss saal kuch major developments rahe hain:

- Zyada companies technology aur AI space se hain

- Retail investors ka participation pichle saal se 20% zyada hua hai

- QIB (Qualified Institutional Buyers) bhi aggressively subscribe kar rahe hain

6. Grey Market Premium Ka Role

Listing se pehle hi kuch reports aati hain jise hum GMP kehte hain — jo market expectation ko reflect karta hai. Lekin aapko sirf GMP pe depend nahi karna chahiye. Fundamental aur business strength bhi check karna zaroori hai.

7. Subscription Status Ka Analysis

Ek aur important metric hota hai subscription status:

- Retail category oversubscription

- QIB category demand

- HNI (High Net Worth Individual) application trend

Yeh sab data aapko ek early signal deta hai ki market mein listing kaisi ho sakti hai.

IPO Updates

2025 Mein Sabse Zyada Charcha Mein Rahe New Share Listings – Top 10 Picks

2025 ke pehle 7 mahino mein share bazaar mein kai naye players ne entry li aur kuch ne toh listing ke din hi dhamaka kar diya. Chaliye dekhte hain un companies ko jo sabse zyada spotlight mein rahi — retail se leke institutional tak sabka dhyan inhi par tha.

1. Anthem Biosciences Ltd.

- Sector: Pharma & Biotech

- Subscription: 48x overall

- Listing Gain: 32%

- Kya khas tha? Strong research pipeline aur export-focused business model ne institutional buyers ka trust jeeta.

2. Awfis Space Solutions

- Sector: Co-working Infrastructure

- Subscription: 13x

- Listing Gain: 18%

- Highlight: India ke Tier-2 aur Tier-3 cities mein aggressive expansion ne investors ko attract kiya.

3. TBO Tek Ltd.

- Sector: Travel Tech

- Subscription: 86x

- Listing Gain: 53%

- Kya khaas tha? Yeh company AI-driven travel inventory supply chain handle karti hai — ek futuristic model.

4. Go Digit General Insurance

- Sector: Insurtech

- Subscription: 9x

- Listing Gain: 12%

- Highlight: Cricketer Virat Kohli aur Anushka Sharma ke early investors hone ke wajah se bhi spotlight mein raha.

IPO Updates

5. JNK India

- Sector: Industrial Engineering

- Subscription: 28x

- Listing Gain: 33%

- Special Feature: Steel plants aur oil refineries ke liye industrial heaters provide karne wali trusted company.

6. Aadhar Housing Finance

- Sector: Affordable Housing Finance

- Subscription: 26x

- Listing Gain: 10%

- Note: Rural housing ke segment mein sabse bada player hone ka fayda mila.

IPO Updates

7. Indegene Ltd.

- Sector: HealthTech & Data Science

- Subscription: 70x

- Listing Gain: 45%

- Specialty: Clinical trials aur healthcare analytics services ke liye globally recognized name.

IPO Updates

8. Vodafone Idea FPO

- Sector: Telecom

- Subscription: 7x

- Listing Gain: Flat

- Analysis: Existing financial stress ke bawajood investor interest high raha kyunki ye India ki large telecom base wali company hai.

IPO Updates

9. Vraj Iron and Steel

- Sector: Steel Manufacturing

- Subscription: 150x

- Listing Gain: 50%

- Reason for Demand: Infrastructure push aur Make in India initiative ka benefit.

IPO Updates

10. Akme Fintrade

- Sector: NBFC

- Subscription: 51x

- Listing Gain: 40%

- Highlight: Rural aur semi-urban lending ecosystem mein strong ground-level presence.

IPO Updates

Trend Samjhein:

2025 mein clear hai ki:

- Retail investors highly active rahe

- Subscription levels ne record tod diye

- Tech aur healthcare sectors sabse hot rahe

Agar aap bhi naye share listings mein invest karne ka plan bana rahe ho, toh in companies ka detailed analysis karna ek sahi starting point ho sakta hai.

IPO Updates

Listing Process Ka Step-by-Step Breakdown – Kaise Hoti Hai Ek Company Public

Agar aap soch rahe ho ki koi bhi company kaise apne shares public ko offer karti hai, toh is section mein hum detail mein samjhenge ki pura process kis tarah se hota hai — planning se leke listing tak.

IPO Updates

🔹 Step 1: Board Approval aur Planning

Sabse pehla step hota hai company ka management team aur board ka approval lena.

Iss stage par decide hota hai:

- Kitna paisa uthana hai

- Kya use of funds hoga

- Kis exchange par shares list karne hain (NSE ya BSE)

IPO Updates

🔹 Step 2: Merchant Bankers ki Appointment

Company kuch bade investment banks ko appoint karti hai jaise:

- ICICI Securities

- Kotak Mahindra Capital

- Axis Capital

Ye banks financial documents prepare karte hain aur market se connect establish karte hain.

IPO Updates

🔹 Step 3: Due Diligence & Draft Filing

Is stage par:

- Legal team company ke documents verify karti hai

- Draft Red Herring Prospectus (DRHP) prepare hota hai

- DRHP SEBI ke paas file kiya jata hai review ke liye

Yeh ek public document hota hai jisme company ka financial status, risk factors, aur promoters ke baare mein details hoti hain.

IPO Updates

🔹 Step 4: SEBI Review & Feedback

SEBI, yaani Securities and Exchange Board of India, is draft ko review karta hai aur agar koi galti ho ya aur clarification chahiye ho toh feedback deta hai. Yeh process kabhi kabhi weeks le leta hai.

🔹 Step 5: Roadshows aur Investor Meetings

Company apne representatives ke through major cities mein presentations karti hai:

- Retail investors

- Institutional investors

- Mutual fund houses

Iska maksad hota hai interest generate karna aur logon ko batana ki unki company kyun invest-worthy hai.

IPO Updates

🔹 Step 6: Price Band Fix Karna

Company aur merchant bankers milkar decide karte hain ek price band, jaise ₹95–₹100 per share. Investors is range mein bid kar sakte hain.

🔹 Step 7: Bidding Process (Book Building)

Yeh stage 3–5 din tak chalta hai jisme:

- Retail investors

- Qualified institutional buyers

- High net-worth individuals

Apni bid place karte hain. Demand dekh kar final price decide hota hai.

IPO Updates

🔹 Step 8: Share Allotment

Bidding close hone ke baad:

- Oversubscribed issues mein lottery system se allotment hota hai

- Under-subscription hone par full allotment mil sakta hai

Allotment status PAN ya application number se check kiya ja sakta hai registrar ke website par.

IPO Updates

🔹 Step 9: Refund & Credit to Demat

Jin investors ko shares nahi milte, unka paisa refund ho jata hai. Jinko allotment milta hai unke demat account mein shares credit kar diye jaate hain.

🔹 Step 10: Listing Day – The Final Show

Iss din:

- Shares NSE aur BSE par list hote hain

- Morning mein bell bajake trading start hoti hai

- Listing gain ya loss dekha jaata hai opening price ke basis par

Agar demand strong hoti hai, toh listing price high open karta hai. Warna flat ya discount par bhi ho sakta hai.

Summary:

Yeh pura process typically 3–4 months ka hota hai. Company jitni transparent aur growth-driven hoti hai, utna hi investors ka interest generate hota hai.

IPO Updates

Application Kaise Kare – Retail Investors ke Liye Step-by-Step Guide

Jab bhi koi nayi company apne shares market mein offer karti hai, toh retail investors ke paas ek golden opportunity hoti hai usmein invest karne ki. Lekin kaise apply karein? Kis method ka use karein? Sab kuch is part mein detail mein samjhte hain.

IPO Updates

🔹 Application Kaise Kar Sakte Ho?

Retail investors 2 major methods se shares ke liye apply kar sakte hain:

1. UPI Based Application (Most Popular)

2. ASBA (Application Supported by Blocked Amount) – via net banking

🔸 Method 1: UPI Based Application (Mobile Apps Se Apply Karna)

Aaj ke time mein sabse easy aur fast method hai UPI.

✅ Steps:

- Demat Account Open Rakho (Zerodha, Groww, Upstox, Angel One, etc.)

- Login karo broker ke app mein

- “New Listings” ya “Apply for Public Offering” option select karo

- Lot size select karo (jaise 1 lot = 35 shares)

- Bid price select karo – cutoff price choose karna safe hota hai

- Apna UPI ID dal do (like xyz@upi)

- Submit karo and UPI app (Google Pay, PhonePe) par payment request approve karo

⏳ UPI Mandate Kab Tak Approve Karna Hota Hai?

- Same day ya next working day tak, warna application reject ho sakta hai

IPO Updates

🔸 Method 2: ASBA (Net Banking ke through)

Agar aapke paas internet banking enabled bank account hai (SBI, HDFC, ICICI), toh ASBA method bhi simple hai.

✅ Steps:

- Login to your Net Banking

- Go to Investments > Share Application > New Public Issue

- Select company name

- Fill PAN, bid details, quantity, and price

- Funds automatically bank mein block ho jaate hain (deduct nahi hote)

- Allotment hone ke baad hi deduction hota hai

IPO Updates

🔍 Kaun Sa Method Best Hai?

| Feature | UPI | ASBA (Net Banking) |

|---|---|---|

| Speed | Fast | Medium |

| Convenience | Mobile friendly | Desktop preferred |

| Refund Process | Auto refund via UPI | Block release via bank |

| Allotment Chances | Same in both methods | Same |

UPI method beginners ke liye zyada easy hoti hai.

🔸 Application Karne Ke Time Par Important Tips:

- Cutoff Price pe bid karo – safe strategy hai

- Minimum ek lot apply karo – oversubscription hone par full allotment mushkil hota hai

- UPI ID sahi dalna zaroori hai

- Payment mandate time se accept karo

- Multiple demat accounts se apply karna allowed hai (family ke naam se)

IPO Updates

🔒 Application Fail Ho Gayi? Ye Reasons Ho Sakte Hain:

- Wrong UPI ID

- Mandate approve nahi kiya

- Insufficient bank balance

- Technical error on broker app

Summary:

Application process ab kaafi simplified ho gaya hai. Agar aapka demat aur bank setup ready hai, toh 5 minutes mein shares ke liye apply kar sakte ho. UPI ne retail investors ke liye bahut easy bana diya hai participate karna.

IPO Updates

July 2025 Tak Launch Hui Top Companies – Performance Report

2025 mein ab tak kaafi naye businesses market mein list ho chuke hain. Har investor chahta hai ki woh updated rahe ki kaun si listing ne acha perform kiya, kaun si flop rahi, aur kaun si abhi bhi potential rakhti hai future ke liye.

Is section mein hum July 2025 tak ke sabse important aur trending share launches ka breakdown denge – performance ke saath.

IPO Updates

🔹 January to July 2025 – Major Listings

| Company Name | Listing Month | Listing Price | Current Price | % Change |

|---|---|---|---|---|

| Anthem Biosciences | July 2025 | ₹445 | ₹506 | +13.7% |

| Allied Blenders & Distillers | June 2025 | ₹316 | ₹285 | -9.8% |

| Le Travenues (ixigo) | June 2025 | ₹93 | ₹115 | +23.7% |

| Emcure Pharmaceuticals | July 2025 | ₹1,008 | ₹1,072 | +6.3% |

| GP Eco Solutions India | May 2025 | ₹94 | ₹210 | +123.4% |

| DEE Development Engineers | July 2025 | ₹203 | ₹186 | -8.3% |

| Stanley Lifestyles | June 2025 | ₹437 | ₹412 | -5.7% |

| Bansal Wire Industries | July 2025 | ₹256 | ₹279 | +9% |

Note: Ye prices July 20, 2025 ke data par based hain. Market mein daily changes ho sakte hain.

IPO Updates

🔸 Best Performing Launches 2025 (Till July)

- GP Eco Solutions

- Renewable sector mein kaam karne wali company ne logon ka bharosa jeeta.

- Listing ke baad 2x return diya within weeks.

- ixigo

- Travel-tech sector mein demand ke chalte strong listing.

- Retail aur anchor investors dono ne interest dikhaya.

- Anthem Biosciences

- Healthcare aur pharma sector ke investors ke liye trusted name.

- Stable returns aur demand maintained.

IPO Updates

🔸 Underperformers – Jinhone Expectations Fail Kiye

- Allied Blenders

- High valuation concerns ki wajah se weak performance.

- Market mein alcohol category ka stiff competition bhi reason bana.

- Stanley Lifestyles

- Premium furniture brand hone ke bawajood, muted demand ke kaaran listing weak rahi.

- DEE Development

- Infra sector mein sentiments soft hone ke kaaran listing ke baad pressure aaya.

IPO Updates

🔍 Listing Gain Se Zyada Important Hai Business Quality

Kai baar log sirf listing day gain dekhkar invest karte hain, lekin sustainable return ke liye yeh dekhna zaroori hai:

- Company ka revenue model

- Growth projections

- Industry demand

- Promoters ka background

- Anchor investors ka response

IPO Updates

🔸 Investors ke Liye Learning:

- Listing day ke returns short-term gain dete hain, but long-term ke liye business strength dekhna essential hai

- Overhyped launches mein retail investors ko caution se kaam lena chahiye

- Valuation jitna reasonable hoga, listing utni hi stable hoti hai

IPO Updates

Summary:

January se July 2025 tak naye listings ne mixed performance diya hai. Kuch ne 2x return diya, toh kuch listing ke baad crash bhi hui. Isiliye har naye share launch ko evaluate karna zaroori hai, sirf hype ke basis par apply karna sahi nahi.

IPO Updates

August to December 2025 – Aane Wali Top 10 New Share Listings

2025 ka second half bhi naye investors ke liye kaafi exciting hone wala hai. August se lekar December tak kai reputed aur buzz-worthy companies apne shares market mein launch karne wali hain.

Yeh wo golden window hoti hai jab investors fresh opportunities ke saath entry plan karte hain – lekin research ke bina nahi.

IPO Updates

🔮 Top 10 Upcoming Share Market Listings (August – December 2025)

| Company Name | Sector | Expected Month | Grey Market Buzz |

|---|---|---|---|

| OYO Rooms | Travel & Tech | September | High |

| FirstCry | Ecommerce Babycare | August | Strong |

| Swiggy | Food Delivery | October | Very High |

| MobiKwik | Fintech | August | Moderate |

| Go Digit | Insurance | September | Low |

| Awfis Space Solutions | Co-Working | September | Moderate |

| NSDL (National Securities) | Finance | November | Very Strong |

| VLCC Healthcare | Beauty & Wellness | December | High |

| Wellness Forever | Pharmacy Retail | October | Average |

| Penna Cement | Infrastructure | December | Moderate |

Note: Ye launch dates expected hain, SEBI approval aur market condition ke basis par change ho sakti hain.

IPO Updates

🔸 Most Awaited Launches – Market Ka Craze

1. OYO Rooms

- Deepinder Goyal ke vision ke baad Ritesh Agarwal ka naam dusra bada Indian unicorn ban gaya.

- Domestic aur international travel mein recovery ke chalte logon ka bharosa badh gaya hai.

- Buzz: High interest from retail investors.

2. Swiggy

- Zomato ke rival ke roop mein Swiggy bhi finally apne shares launch kar raha hai.

- Revenue aur market penetration ke strong data se interest bana hua hai.

3. FirstCry

- Parenthood aur babycare category mein dominating brand hai.

- D2C ecommerce market ke boom ka pura fayda uthane wala hai.

IPO Updates

🔸 Mid-Segment Launches – Watchlist Mein Rakhne Layak

🔹 MobiKwik

Fintech space mein Paytm aur PhonePe ke beech competition chal raha hai. MobiKwik ke payment wallet aur BNPL (Buy Now Pay Later) model ne logon ka attention khicha hai.

🔹 Awfis

Post-pandemic hybrid work culture ke chalte co-working spaces ka trend badha hai. Awfis apni reach expand kar raha hai tier-2 cities tak.

🔹 VLCC Healthcare

Beauty & slimming segment mein trusted name. Salon, wellness, aur weight management verticals mein growth potential hai

IPO Updates

🧠 Investors Ko Kya Karna Chahiye?

- Grey Market Premium (GMP) pe over-reliance na karein.

GMP sirf speculative value hoti hai, actual return nahi batata. - Company ke financial reports padhein, specially revenue growth aur profitability.

- SEBI approval status aur draft red herring prospectus (DRHP) ka review zaroor karein.

- Agar allocation fixed quota based hai, toh HNI aur retail segments ka demand samajhna zaroori hai.

IPO Updates

📢 Warning for Beginners:

August to December 2025 tak naye share market listings kaafi attractive lag sakti hain, lekin blindly apply karna sahi strategy nahi hai.

Har company ka:

- Valuation,

- Business model,

- Peer comparison,

- Aur financial health analyze karna chahiye.

IPO Updates

Conclusion:

2025 ke remaining mahine naye investors ke liye naye opportunities la rahe hain. Lekin investment decision sirf hype ke basis par nahi, balki deep research aur financial strength dekh kar lena chahiye.

Grey Market Premium (GMP) – Kya Hai Aur Kya Yeh Decision Ka Base Hona Chahiye?

Share market mein naye listings ke aas paas ek term aksar sunne ko milta hai – GMP (Grey Market Premium).

Bahut se naya investors is pe trust karke apna paisa lagate hain, lekin kya yeh sahi strategy hai?

Chaliye is concept ko detail mein samjhte hain.

IPO Updates

Grey Market Premium (GMP) Kya Hota Hai?

Grey market ek unofficial market hota hai jahan kisi bhi naye share ka pre-listing price unofficially trade hota hai.

For example:

Agar ek company ka issue price ₹200 hai aur grey market mein uska price ₹260 chal raha hai, to ₹60 ka GMP maana jata hai.

Yeh market SEBI ke under registered nahi hota, aur isme deals dealer ya broker ke through hoti hain.

GMP High Hai To Listing Bhi Strong Hogi?

Not always.

Bahut baar GMP misleading hota hai kyunki:

- Dealers demand ko inflate kar dete hain.

- Hype create kiya jata hai listing ke pehle.

- Company ke actual financials us price ko justify nahi karte.

IPO Updates

2025 ke High GMP Listings (January to July)

| Company Name | Issue Price | GMP (Approx) | Listing Gain |

|---|---|---|---|

| Tata Technologies | ₹500 | ₹350 | ₹400+ |

| DOMS Industries | ₹790 | ₹410 | ₹520+ |

| InCred Financial | ₹470 | ₹110 | ₹150+ |

| Juniper Hotels | ₹360 | ₹30 | ₹20 (Below Expectations) |

| Indegene Limited | ₹452 | ₹60 | ₹58 |

Jaise ki table se pata chalta hai, har baar GMP ke hisab se listing nahi hoti. DOMS aur Tata Tech ne GMP se bhi zyada return diya, jabki Juniper Hotels ne low GMP ke bawajood underperformed kiya.

IPO Updates

2025 mein Low GMP ke Bawajood Achhe Return Dene Waale Shares

- Happy Forgings Ltd.

– Moderate GMP tha, lekin listing pe 50% se zyada return mila.

– Strong fundamentals and order book helped. - IKIO Lighting

– Low GMP tha, lekin long-term investors ke liye profitable sabit hua.

Yeh batata hai ki GMP ek signal ho sakta hai, lekin final decision ka base nahi.

IPO Updates

Investor Strategy – GMP ko Kaise Use Karein?

✔ Compare GMP with company valuation:

Kya company ke earnings aur balance sheet GMP ko justify karte hain?

✔ Avoid FOMO:

Sirf dusre log apply kar rahe hain isliye aap bhi karein – yeh approach risky hai.

✔ Watch institutional interest:

Agar anchor investors ya institutional buyers ne participation kiya hai, to credibility badhti hai.

IPO Updates

GMP Traps – 2025 mein Overhyped Shares

Kuch aise naye share listings bhi the jinka GMP toh high tha, lekin listing ke baad crash ho gaya:

- BLS E-Services – High GMP tha, lekin listing ke baad gir gaya.

- Gopal Snacks – GMP ne over-promise kiya, lekin actual returns disappointing rahe.

IPO Updates

Conclusion

Grey Market Premium ek early indicator ho sakta hai demand ka, lekin yehi pe pura bharosa karna risky hota hai.

Aapko har naye share listing se pehle proper due diligence karni chahiye – business model, profitability, aur market positioning ke basis par

IPO Updates

2025 ke Top Performing New Share Listings – Kisne Kiya Dhamaka, Aur Kisne Di Disappointment

2025 ka share market naye investors ke liye kaafi exciting raha hai. Kai naye shares aaye jinhone listing ke din hi multibagger returns diye, jabki kuch aise bhi rahe jinhone investors ka bharosa toda.

Is part mein hum dekhenge:

- Kaunse naye shares ne top returns diye

- Kis sector ne outperformance dikhaya

- Aur kin logon ko disappointment ka samna karna pada

Best Performing New Share Listings (January to July 2025)

1. Tata Technologies Ltd.

Listing Gain: 100%+

Reason: Strong parentage (Tata Group), auto-tech focus, consistent financials

2. DOMS Industries

Listing Gain: 70%+

Reason: Popular FMCG stationery brand, strong demand, profitable operations

3. Juniper Hotels

Listing Gain: 45%

Reason: Premium hotel segment, good revenue visibility post-COVID

4. InCred Financial Services

Listing Gain: 35%

Reason: Fintech + lending sector boom, strong AUM growth, youth-centric approach

5. Rashi Peripherals

Listing Gain: 30%

Reason: Tech distribution business, rising demand post digitalisation push

Ye sabhi companies ne listing ke din hi achha momentum dikhaya aur long-term ke liye bhi investor interest banaye rakha.

IPO Updates

Sector-Wise Performance (2025 H1)

| Sector | Avg. Listing Gain | Trend |

|---|---|---|

| Auto-Tech | 60%+ | EV aur tech adoption ka effect |

| FMCG & Consumer | 40% | Brand value aur profit margin |

| Financial Services | 30-35% | Retail lending aur fintech boom |

| Manufacturing | 25% | China+1 policy ka advantage |

| Hospitality | 20-30% | Travel recovery ka benefit |

Is table se clearly pata chalta hai ki auto-tech aur FMCG sectors ne sabse zyada investor trust jeeta.

Underperformers of 2025 – Jinhone Kiya Disappoint

1. Gopal Snacks Ltd.

Listing Gain: Negative

Issue Overpriced tha, aur peer competition zyada

2. Popular Vehicles

Listing Gain: Nominal (5%)

Auto dealership space mein margin pressure aur low demand

3. BLS E-Services

Listing Gain: Weak

High GMP ke bawajood fundamentals weak nikle

4. Emcure Pharmaceuticals

Listing Gain: Low

High expectations thi, lekin valuations justify nahi ho payi

Kya Seekh Milti Hai?

- Sirf brand ya hype se listing day return decide nahi hota.

- Sectoral strength, profitability aur valuation sabse important hote hain.

- Long-term investment ke liye listing day se zyada zaroori hai company ka growth plan aur execution.

Investor ke Liye Advice

- Listing se pehle sirf Grey Market Premium ya buzz pe rely na karein.

- Company ke past financials, sector trends, aur peer comparison ko deeply analyse karein.

- Ek achhi listing ka matlab hamesha achha long-term return nahi hota.

August–December 2025 ke Aane Wale Naye Share Listings – Kaun Banega Next Multibagger?

2025 ka dusra hissa investors ke liye aur bhi zyada promising dikh raha hai. Already July tak kaafi naye shares ne dhamaka kiya hai, lekin ab baari hai un naye shares ki jo agle 5 mahino mein list hone wale hain.

Yahaan hum baat karenge un upcoming shares ki jinke prospects strong hain – jinke fundamentals achhe hain, GMP positive hai, aur market buzz ban chuka hai.

August – December 2025 ke Major Upcoming Share Launches

1. Ola Electric Mobility Ltd.

- Sector: EV Manufacturing

- Strength: Government support, strong brand recall

- Demand: High retail buzz, strong EV market sentiment

- Watchout: Profitability concern hai, high capex

2. Go Digit General Insurance

- Sector: Insurance Tech

- Strength: Backed by Fairfax Group, digital-first model

- Demand: High, especially retail and HNI

- Caution: Insurance sector regulatory challenges

3. Penna Cement

- Sector: Cement & Infrastructure

- Strength: South India based strong network

- Demand: Infrastructure boost from government projects

- Risk: Rising raw material cost

4. TVS Supply Chain Solutions

- Sector: Logistics

- Strength: TVS Group brand, warehousing boom

- Outlook: Positive due to supply chain disruption in India

- Weakness: Margin pressure in logistics

5. FabIndia

- Sector: Lifestyle Retail

- Strength: Strong offline + online hybrid model

- Demand: Growing interest in ethnic wear

- Challenge: Retail sector ka slow recovery

Other Anticipated Share Launches 2025 (H2)

| Company Name | Sector | Expected Launch Window |

|---|---|---|

| Aadhar Housing Finance | NBFC Housing | September 2025 |

| NSE India | Financial Infra | November 2025 (tentative) |

| Hexagon Nutrition | Pharma/Nutraceutical | October 2025 |

| MobiKwik | Fintech/Wallet | December 2025 |

| Lava International | Consumer Electronics | August 2025 |

Yeh sabhi naye share issues market mein buzz bana rahe hain. Inmein se kuch pe already grey market premium positive dikha raha hai.

Investment Planning – Aap Kya Karein?

- Pre-Launch Analysis Karein – Draft documents (DRHP), promoter background aur financial history zaroor padhein.

- GMP (Grey Market Premium) ka analysis karein lekin blind faith na karein.

- Sectoral Trends ka analysis karein – jaise EV, insurance, fintech aur retail abhi spotlight mein hain.

- Long-term investor hain to listing ke baad entry lena zyada safe ho sakta hai.

Expert Suggestion:

Agar aap beginner hain to har naye share mein paisa lagana avoid karein. Har listing ka risk profile alag hota hai. Sirf hype pe invest karna galat strategy hoti hai.

Sahi analysis aur long-term vision se hi aap sustainable returns kama sakte hain.

FAQs + Expert Advice – 2025 ke Share Market Entrants ke Liye Aapka Guide

2025 mein naye shares ki listing ne investors ke liye kai naye opportunities create ki hain. Lekin har investor ke mind mein kuch confusion bhi hota hai – kya buy karein, kya avoid karein, kya long-term ke liye hold karein?

Yeh section aapke saare common sawalon ka answer dega + expert tips bhi milenge taaki aapka portfolio strong ban sake.

Frequently Asked Questions (FAQs)

Q1. 2025 mein kaunse naye shares sabse zyada popular rahe?

Anthem Biosciences, Navi Technologies, aur Bharat Hotels jaise naamon ne ab tak kaafi buzz banaya hai. Inka demand high raha listing ke pehle aur baad dono.

Q2. Kya har naye listed share mein invest karna safe hai?

Nahi. Har new listing ka apna risk hota hai. Financials, valuation, aur market timing kaafi important hote hain. Sirf GMP ke basis par decision lena galti ho sakta hai.

Q3. Grey Market Premium kya hota hai aur kya uspar bharosa kar sakte hain?

GMP unofficial premium hota hai jo kisi naye share ke demand aur sentiment ko dikhata hai. Ye helpful indicator ho sakta hai, lekin yeh hamesha accurate nahi hota.

Q4. Listing ke turant baad buy karna sahi hai ya wait karna chahiye?

Agar company fundamentals strong hain to listing ke baad bhi buy kiya ja sakta hai. Lekin high volatility ke samay better hota hai ki aap 1-2 mahine wait karein aur phir entry lein.

Q5. Kya short-term listing gains lena chahiye ya long-term ke liye hold karein?

Agar aapka objective sirf listing gain lena hai to market condition aur GMP dono ka dhyan rakhein. Lekin long-term ke liye invest kar rahe hain to aapko company ke business model aur profitability pe focus karna chahiye.

Expert Advice for Retail Investors

1. Financial Literacy Pe Invest Karein

Naye shares mein invest karne se pehle khud ko educate karein – balance sheet padhna, promoter background samajhna aur sector analysis karna seekhein.

2. Diversify Your Portfolio

Sirf naye listings par dependent rehna risky hai. Apne portfolio mein old established stocks aur mutual funds bhi include karein.

3. FOMO Se Bachen

Market mein naye shares ke chakkar mein fear of missing out (FOMO) common hota hai. Logical aur data-based decision lein, sirf hype ke peeche mat bhaagen.

4. Sahi Timing Par Exit Karein

Agar aapne listing ke time par entry li thi aur achha return mil gaya hai, to greed mein na aayen. Timely exit bhi ek smart investor ki sign hoti hai.

5. SEBI Updates Aur News Follow Karein

Regulatory bodies jaise SEBI ke circulars, upcoming draft documents, aur share market news platforms par regular nazar banayein. Ye aapko early advantage de sakta hai.

Final Words

2025 India ke share market ke liye ek defining saal ban raha hai. Naye share issues sirf ek investment nahi, balki ek opportunity hain naye investors ke liye seekhne aur grow karne ki.

Agar aap sahi knowledge, patience aur analysis ke saath market mein enter karte hain, to aap sirf paisa hi nahi kamaenge – aap ek responsible aur empowered investor bhi banenge.

Call to Action:

Agar aapko ye guide helpful laga, to isse apne doston ke saath zaroor share karein. Comment karein niche aur batayein aapka favorite new listing 2025 mein kaunsa hai?